Analyzing Iran import and export statistics are significant for foreign businesses to have an idea of their target market in Iran. Looking at these numbers provides a rough estimate of their ability to sell their products in the new market.

Here, we take a look at Iran’s leading suppliers and the products residing on top of the list of imported goods. For detailed information about your specific products, you can browse our market opportunities library.

NOTE: the Iranian calendar starts from May 20. The current Iranian year is 1396. For this article, we used statistics from the past five years. So, anywhere we mentioned “last year,” it refers to the Iranian year 1395 – falling in the period March 20th 2016-17.

The 15 Biggest Exporters to Iran

In this section, we will first take a look at the last year’s imports. Then we will look at the data for the past five years to see how the top exporters list changed over the period.

Leading Suppliers in 1395

Traditionally, European countries have been the biggest trade partner of Iran. However, during the last decade, the East Asian countries have ascended to become the largest exporters to the country.

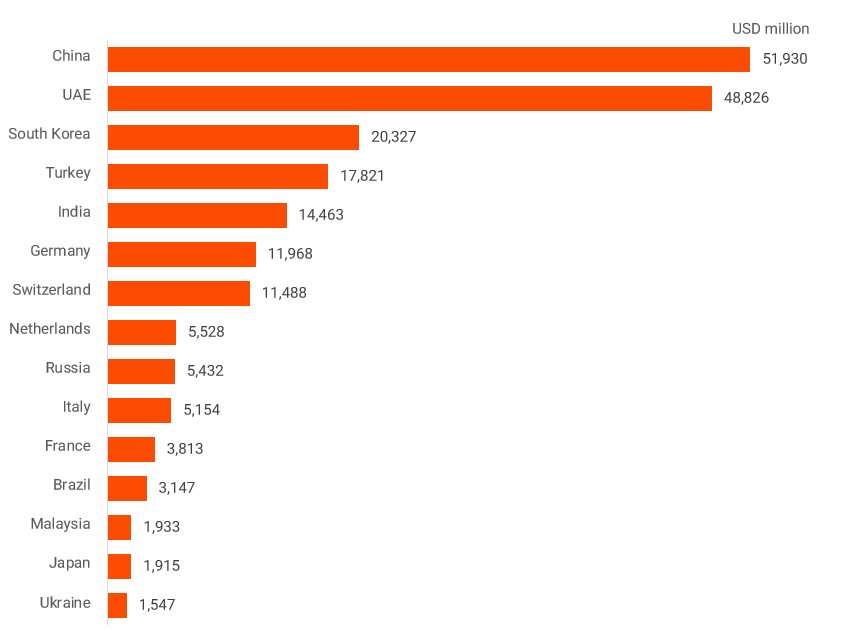

The following table shows the primary sources of Iran import during the 12 months of 1395.

| Country | Export Value (USD million) | Import % of Total |

|---|---|---|

| China | 10,753 | 25% |

| UAE | 6,407 | 15% |

| South Korea | 3,460 | 8% |

| Turkey | 2,738 | 6% |

| Germany | 2,537 | 6% |

| India | 1,955 | 4% |

| Russia | 1,573 | 4% |

| Italy | 1,227 | 3% |

| Brazil | 1,208 | 3% |

| Switzerland | 1,187 | 3% |

| France | 957 | 2% |

| Netherlands | 790 | 2% |

| Ukraine | 622 | 1% |

| Japan | 547 | 1% |

| Malaysia | 476 | 1% |

| Others | 7,247 | 17% |

| Total | 43,684 | 100% |

Top 15 exporters to Iran for the year 1395 | Source: IranPartner, Iran’s Customs Organization

During the past Iranian year, Iran Import totaled at just more than USD 43.6 billion. China, the UAE, and South Korea accounted for 48% of total Iran import. China alone sold more than USD 10.5 billion worth of products to Iran in 1395.

On the other hand, the European countries on this list contributed only 19% of the total exports to Iran. Germany’s exports stood at USD 2.5 billion followed by Italy and Switzerland’s USD 1.2 billion.

The following map shows the distribution of these exporters across the globe. As you can see, Iranian tend to buy from East Asian and Central European countries along with India and Russia.

Distribution of leading exporters to Iran. | Source: IranPartner, Iran’s Customs Organization

But, the US, UK, Canada, and Australia are not benefiting the trade opportunities with Iran. The reason lies in the conflicts between the US government and the Iranian government, which existed around for the past four decades. Also, the UK, Canada, and Australia are doing less business with Iran than their European peers, given their stronger alliance with the US’s policies towards Iran.

Finally, the only Latin American country on this list is Brazil, which is a major supplier of essential agricultural products such as corn, soybean, beef, and sugar to Iran.

The following figure shows how much these 15 countries exported to Iran during the 1391-1395 period.

Total export value of the top 15 countries from 1391 to 1395. | Source: IranPartner, Iran’s Customs Organization

Together, China and the UAE exported about USD 100 billion to Iran during five years. These two countries were by far the biggest winners of the international sanctions on Iran. With other nations refraining from doing business with Iran, China and the UAE dominated the market.

Also, the other Asian suppliers, namely South Korea, Turkey, and India played a significant role in Iran’s foreign trade during the past five years. South Korean companies earned USD 20 billion from exports to Iran, while Turkish and Indian businesses made more than USD 17 billion and USD 14 billion respectively.

Trailing these Asian players, European countries such as Germany, Switzerland, the Netherlands, Russia, Italy, and France were the other big trade partners for Iran during the period. On average, Germany and Switzerland exported USD 2 billion per year, while the other four countries made an annual revenue of USD 1 billion.

Now, let’s see how the top exporters list changed over the years.

How & why did the top exporters’ ranking change during the past five years?

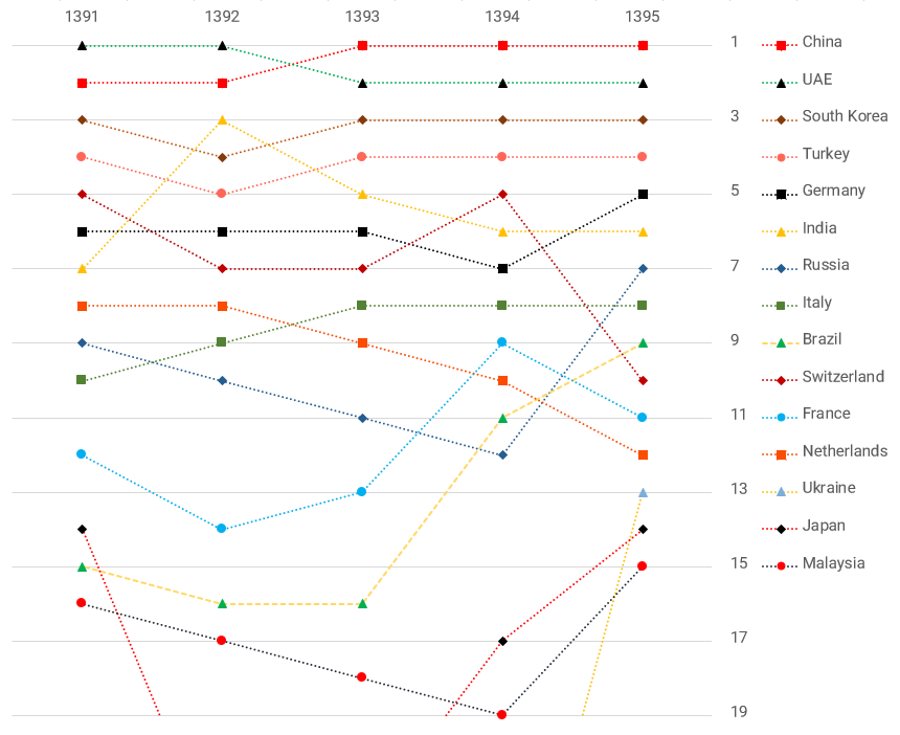

Here, we looked at the import statistics to uncover the trends in Iran’s foreign suppliers. We examined the data for the last five years between 1391 to 1395, a period that roughly translates to the March 20th, 2012 to March 20th, 2017 range.

The following figure shows the data for the top 15 exporters we reviewed in the previous section. The data points show the rank of the country on the list of top exporters to Iran.

Overview of the developments in the major 15 exporters list between 1390-1395. | Source: IranPartner, Iran’s Customs Organization

Ranking alone does not provide an accurate picture of the variations in these countries’ exports to Iran. To better understand how their trades changed during the past five years, we examined how much of the overall trade happened in each of the five years.

The breakdown of the top 15 exporters’ performance in each of the years between 1391 to 1395. Each year’s percentage shows how much of the country’s total 5-year exports happened in that particular year. | Source: IranPartner, Iran’s Customs Organization

So, what are the driving factors for the changes in the exports to Iran?

Let’s look at each of the above countries.

China

China is the largest trade partner with Iran. It is the biggest importer from Iran and in return supplies the majority of Iran’s needed goods. China’s exports to Iran has been relatively robust during the recent years. As of the year 1395, China contributed to about a quarter of Iran import.

Obviously, China’s reorientation towards becoming an export-oriented economy has been the biggest contributor to the country’s role as the primary exporter to Iran. However, we should not forget the developments that accelerated China’s involvement in Iran during the recent years.

First, as the international sanctions prohibited foreign business with Iran, China found ways to stay in the country and expand its operations. They remained the biggest buyer of Iranian oil during the sanctions. As the banking restrictions made money transfer costly, Iran decided to barter its money in Chinese banks in exchange for products. Also, Iran would pay Chinese contractors that worked on large-scale projects in Iran using these funds.

Second, Iranian industries have traditionally been focusing on the domestic market. Government support has insulated them from foreign competition. As a result, local manufacturers lost their competitiveness in the global market. With the government now contemplating joining the World Trade Organization, estate support for local businesses is decreasing. Iranian manufacturers that find it impossible to compete in the new environment rely on Chinese OEM/ODMs to reduce their production costs.

UAE

The United Arab Emirate is a regional trade and finance hub. Its role as a regional financial and commercial hub supports UAE’s vital role in Iran import and export operations. As the international sanctions restricted Iran’s access to the global economy, UAE-based enterprises kept the business going on.

Dubai’s favorable business environment attracts numerous Iranian companies to set up subsidiaries in the city. Also, fast delivery and ease of fund transfer make Dubai-based suppliers the number one choice for Iranian importers.

The country’s highest export volume to Iran occurred in 1392 and 1393, right after the imposition of the most limiting sanctions on Iran. At the time, European companies refused to sell their products to Iran, so local businesses used their relations with Dubai to acquire their needed products. As Iranian importers found new suppliers in other corners of the World, Dubai’s share in Iran import decreased, but it is still the second largest exporter to Iran.

South Korea

South Korea is the third biggest exporter to Iran. The country has been active across a broad range of industries, from mega infrastructure projects to the consumer markets.

Like China, South Korea was one of the largest importers of Iranian oil and kept buying even during the sanctions years. Also, like China, not being able to transfer funds to Iran meant that Korean companies would get paid by Iranian funds in Korean banks. Thus, the role of Korean businesses in Iranian government-owned projects soared during the past five years.

Iranians consider Korean products to have higher quality than those made in China. Also, being more affordable than European goods, made-in-Korea products enjoy strong demand in the Iranian market.

Turkey

The fourth country on the list of Iran import origins is the neighboring Turkey. The geographic and cultural closeness coupled with Turkish people’s ties with the northwestern provinces of Iran drive its robust share in Iran.

Turkey’s export to Iran has been diminishing in recent years, mainly because of the political differences in their views towards regional developments and the disputes about Iran’s selling natural gas to Turkey. But, with the two sides actively resolving their differences, the outlook for bilateral business seems promising.

Germany

Germany is Iran’s leading trade partner in Europe. The two countries’ trade relationship has a long history, and the Iranian consumers highly favor German products. Also, Germany has had one of the most stable export shares to Iran during the last five years. Germany’s exports to Iran vary from medical and pharmaceutical products to machinery and equipment.

High local inflation resulted in a steep depreciation of the Iranian Rial. As a result, many of the European products consumer products lost their market in Iran. However, German companies have remained active in the industrial and infrastructure sector. Also, Iran’s medical import from Germany remains high.

After the sanctions, Germany’s share in Iran import increased. Given the number of signed contracts on large-scale projects, German activity in Iran seems to be set to rise – at least in the industrial equipment and infrastructure markets.

India

India’s trade with Iran peaked right after the imposition of the international sanctions on Iran in 2012. India has been a significant trade partner with Iran. But the country’s rise on Iran import list had a similar reason to China and South Korea’s sanction-era trade with Iran.

India was one of the few buyers of the Iranian oil. Unable to get the funds back to Iran, the government focused on importing products from India. However, unlike China and South Korea, India lacked the capabilities to participate in Iran’s state-owned projects. So, the main part of the Iran import from India was commodities such as rice and tea.

With the lifting of sanctions, India’s share in Iran import declined substantially. But they remain to be one of the strategic trade partners with Iran.

Russia

Despite the past hostility that has existed between Iran and Russia in recent centuries, Russia has turned to become one of the biggest trade partners with Iran. Politics played a significant role in raising the economic relations between the two countries.

Steel, Agricultural products, and wood are Russia’s primary exports to Iran. Nonetheless, Russia’s position on Iran import origins has been declining in recent years.

Nevertheless, Russia’s position on Iran import origins has been declining over the past few years. International sanctions and the money transfer problems were the primary reasons for this decrease in business. Unlike China and South Korea, Russia is not an oil importer. With no fund to pay for Russian exports, the country’s sales to Iran decreased steadily during sanctions.

However, with the lifting of the sanctions, Russia resumed exports to Iran, and the bilateral trade seems to be increasing for the next few years.

Italy

Italy is another robust European exporter to Iran. Although the international sanctions hit the country’s exports to Iran, it managed to increase in value during the past five years gradually. Machinery and industrial equipment remain the top exported products to Iran. Also, Italian companies are actively engaged in engineering and maintenance services for Iranian infrastructure projects.

Following the removal of the sanctions on Iran, Italy was the first European country to sign business agreements with Iran. Also, Italy provides its local enterprises with credit lines for exporting their products to Iran, which plays a vital role in encouraging SMEs to start trading with Iran.

Brazil

The only Latin American country on the list of top Iran import origins has been increasing its ties with the country in recent years. The Brazilian government has been sending trade missions to evaluate potential collaboration and encouraging Brazilian companies to expand export to Iran.

Agricultural products and meat constitute the largest part of the Brazil’s exports to Iran. During the last five years, Brazil managed to increase its exports to Iran substantially. They became the ninth biggest supplier to Iran in 1395.

Switzerland

Historically, Switzerland has had positive relations with Iran. However, with the UN Security Counsel’s taking up Iran’s nuclear program in 2005, the trade between the two countries has decreased. Apart from the EU sanctions, Switzerland also implemented some unilateral sanctions on Iran regarding the country’s nuclear program. However, with Iran’s nuclear issue resolving, the state has dropped many of its sanctions on Iran.

Even with the sanctions in place, Switzerland remained one of Iran’s leading trade partners in recent years. Pharmaceutical products, machinery, and agricultural products make up the biggest part of Swiss exports to Iran.

France

As a leading economy in Europe, France has had old ties with Iran. The country has been particularly active in Iran’s automotive and pharmaceutical industries.

The French car-makers Peugeot and Renault have been producing their products in partnerships with Iranian car-makers. The Peugeot’s cars dominate the affordable cars class in Iran. Also, the French pharmaceutical giant, Sanofi, has been one of the major suppliers of medicine to Iran.

After the international sanctions on Iran escalated in 2012, the French car-makers left the country. Many other French companies decreased their operations in the country, resulting in a decline in the value of French exports to Iran.

However, following the lifting of sanctions, the French exports to Iran is set to rise. Iran has signed a deal with Airbus to purchase 100+ airplanes. Also, the car makers returned to Iran with joint venture agreements and plans for assembling a few new models in Iran.

Netherlands

The Netherlands has been one of Iran’s biggest trade partners. However, in recent years, the two countries have fallen into political conflicts regarding Iran’s nuclear program and the roles of the two countries in the Middle East’s developments.

During the sanctions, the Dutch exports to Iran rapidly declined. Many companies with substantial operations in Iran, such as the Royal Dutch Shell, suspended their operations in Iran and the bilateral trade decreased steadily.

But, with the removal of the sanctions and a shift in political attitudes, the business between the two countries might revive in the coming years. Recently, Shell signed a contract to sell a license for a petrochemical plant in Iran. Return of such large corporations could boost the Dutch economic relationships with Iran.

Ukraine

Ukraine has not been a major trade partner with Iran. However, with Iran’s domestic demand for animal’s feed, mainly corn and soybean meal, and the competitive prices of Ukrainian products, the country rose to become the 13th largest exporter on Iran import list.

Japan

The trade relationship between Iran and Japan is limited to Iran selling petroleum and buying automobiles and electronic devices. The international sanction took a toll on Japanese exports to Iran, resulting in a sharp decline in exports in 1392.

With the removal of the sanctions, the two countries are trying to increase their economic relations. Japanese companies are seeking entry into Iran’s oil industry. The possibilities for machinery trade is also notable.

Malaysia

Malaysia’s presence on the top 15 list of Iran import origins owes itself to the extensive export of palm oil. Iranian diary and food companies are the primary consumers of the palm oil. During the sanctions, Iranians imported the Malaysian palm oil from the UAE and Turkey. But, with the lifting of the sanctions, they are directly purchasing this product from Malaysian suppliers.

Products on Top of Iran Import List

So, what are Iran’s primary imports?

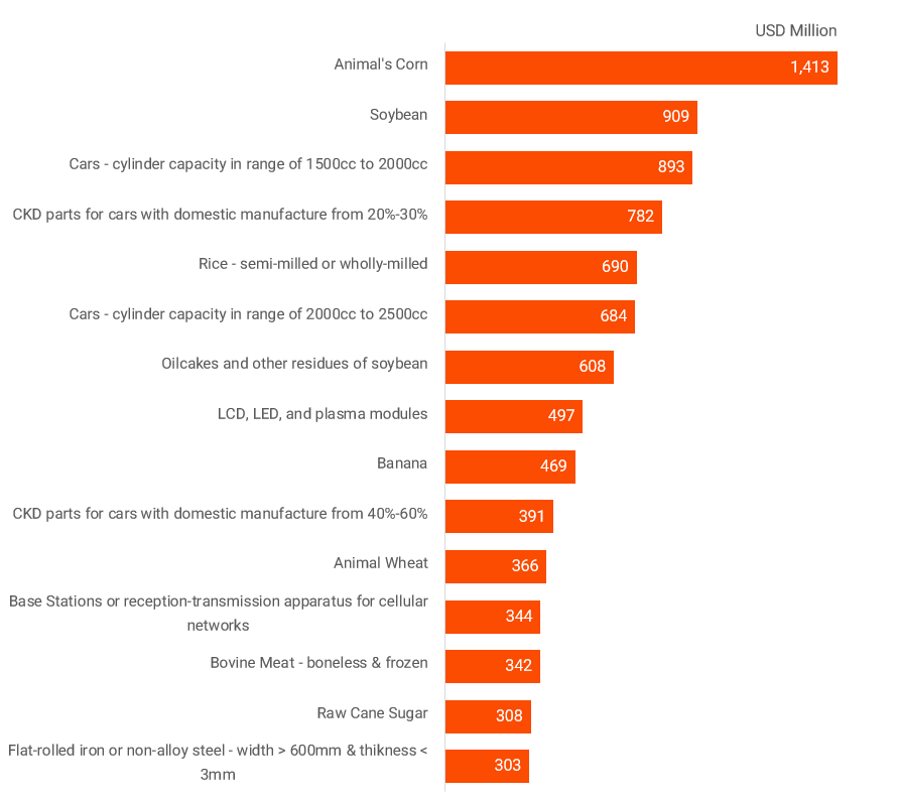

To answer the question, we look at the import statistics of the country for the last Iranian year, i.e., 1395. We examine the import value for each of the HS codes and focus on the top 15 products.

The image below depicts the 15 most imported products to Iran for the mentioned year.

Top 15 Iran imports for the year 1395 | Source: IranPartner, Iran’s Customs Organization

Looking at the above charts, we can see the majority of imported products belong to the following categories:

- Livestock & Poultry Feed

- Agricultural Products

- Automobiles and Auto Parts

- Electronics

- Steel

So, what is behind the high demand for these products?

Livestock & Poultry Feed

Iran is a large country with a population of 80 million. With the goal to provide food for such a community, the Iranian government has encouraged modernization of the livestock and poultry industry.

As a result of government facilitation, the industry experienced rapid growth. Iran’s poultry production surpasses its domestic demand, and local businesses are looking for new overseas markets. The bovine farms have also grown considerably, though the country relies on exports to adequately supply the demand for red meat.

Nonetheless, Iran has mostly an arid climate, which prohibits the production of crops such as corn, soybean, wheat. Although the domestic production is enough for human consumption, the country relies heavily on imports for animal-grade agri-products.

Animal-grade corn, soybean meal, oilcake, and animal-grade wheat are among the most imported commodities to Iran. With the livestock and poultry industry growing fast, the demand for these crops has been driving a big part of Iran’s foreign purchases.

Agricultural Products

Although Iran is among the leading agricultural countries globally, the huge local demand and the unfavorable climate create pressure for the supply of essential products.

Rice and wheat are the main ingredients of Iranian food. While Iran managed to become self-sufficient in the production of wheat, inadequate water resources create a constant under-supply of rice. As a result, Iran relies on imports from India and other East Asian producers for its rice supply.

While there is no restriction on the type of rice imported to Iran, the government bans the import of refined sugar; except for occasional imports intended for short-term balancing of supply and demand. The reason for restriction of sugar import to sugar cane is to protect local manufacturers, who can produce the domestically needed sugar but do not have access to enough raw material in the domestic market.

Apart from the essential commodities, Iran is self-sufficient in the production of fruits and vegetables. Thus, importing fruits and vegetables to Iran is banned, except for the tropical fruits, such as banana, pineapple, coconut, and mango. Curiously, bananas have a high demand in Iran. The fruit continually ranks among the top imported products to Iran.

Automobiles and Auto Parts

Iran has the biggest automotive industry in the Middle East. Iranian companies produce more than one million cars every year. But local production consists of the production of affordable cars for the mass market.

For higher-grade vehicles, Iran relies on imports. The regulations do not permit import of cars with a cylinder capacity of more than 2500cc. East Asian carmakers, particularly Korean brands followed by the Chinese and Japanese, dominate the Iranian market for imported cars. German cars and some newer models of French Peugeot and Renault companies come to Iran via imports.

However, the Iranian government favors foreign carmakers who invest in the local industry. The French companies have long produced their products through joint ventures and third-party manufacturing in Iran. Recently, Chinese and Korean companies have opted for these methods for some of their products.

These operations begin with CKD assembly and grow into assembling a combination of locally-manufactured parts and imported parts. Given the sheer volume of these productions, the CKD parts appear on top of Iran import products list.

Electronics

Iran’s electronics market relies on imports for its needed products; both in the consumer sector and in the industrial sector. Electrical home appliances including televisions are among the most lucrative markets in Iran.

Both Local producers and foreign brands are active in the TV market. In recent years, LG set up a local assembly line to produce selected brands locally. Both local producers and assembled products rely on imported LCD, LED, and plasma panels. The large market size puts these panels on the list of most-imported products to Iran.

The cellular network has been rapidly expanding in Iran. The industry relies on the imported equipment for its infrastructure investments. Given the fast growth of the industry, the electrical radio equipment appears on top of the Iran import list.

Steel

Construction in Iran has been a huge driver of the economy. The need for steel products comes from various infrastructure projects, oil and gas and petrochemical projects, railways and automotive industry.

The government has been investing directly and also encouraging the private sector to participate in the supply chain of the steel industry. However, the downstream of the industry cannot satisfy the local demand for steel products.

Flat-rolled steel is among the most used products across various Iranian industries. However, shortage of domestic supply makes producers to import the product from China, India, and Turkey.

Wrap Up

Iran’s most prominent suppliers are the East Asian economies followed by the Central-European countries. The neighboring UAE and Turkey are also enjoying the high demand in Iran’s markets.

In recent years, the international sanctions disconnected Iran’s financial sector from the global economy. As a result of these nuclear program embargos, Iran’s imports from Europe stalled. Despite the decline in Europe’s business with Iran, European nations such as Germany, Switzerland, Italy, France, and the Netherlands still had significant exports to Iran. With the removal of Iran’s nuclear-related sanctions in 2016, the bilateral trade with these nations is picking up.

On the other hand, the Asian partners played a more significant role in Iran’s foreign trade in the last few years. China and UAE are by far the largest exporters to Iran. South Korea, Turkey, and India are trailing these economies in their trade with Iran.

On the products’ side, Iran relies on imports of particular agricultural commodities, cars and auto parts, electronics, and steel products.

Iran’s arid climate and its flourishing livestock and poultry industries create a massive demand for animal-grade agri-products. Also, the rice and sugar are among the highly imported products.

Although Iran has a considerable auto-industry, it relies on imports of parts for its numerous assembly lines. Also, the local production is limited to affordable cars, and the market relies on imports for the more expensive models.

The electronics market, both the consumer and the industrial equipment segments account for a lot of imported goods. The steel industry, although growing fast, lacks the downstream facilities needed to produce flat products. Thus, steel imports are among the most imported products to Iran.